The Opportunity

International trade volumes surged post-Covid 19, with APAC accounting for over 40% of the USD 23 trillion global trade market in 2023. Within the region, Hong Kong continues to maintain a unique – and outsized – role, with the city consistently ranking among the top 10 global markets by total trade value. However, local trade finance volumes have been on the decline. While much of this has been driven by a combination of macroeconomic and geopolitical headwinds, as well as rising interest rates, financial institutions’ cumbersome back-end processes continue to create notable frictions for borrowers seeking access to lending solutions, which has resulted in a USD 7.8 billion local trade finance gap.

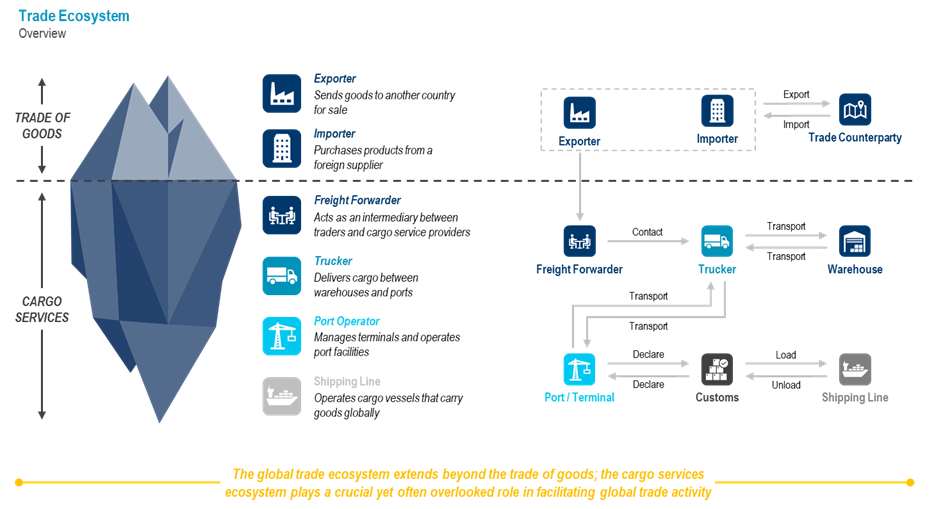

An important but frequently overlooked enabler of global trade finance activity is the cargo service ecosystem, consisting of an intricate network of exporters, importers, freight forwarders, and shipping lines that facilitate the trade of goods. Many of these stakeholders face ongoing working capital shortfalls, primarily in the form of mismatches between payable and receivable maturity periods. And in more recent years, numerous factors have exacerbated these challenges, including sizeable FX fluctuations, volatile cargo service-related charges, rising labour costs, and higher delay-related fees from unexpected port congestions. However, despite the clear demand for credit, most banks have shied away from extending their balance sheets to cargo service participants, citing data limitations, small ticket sizes, an absence of collateral, and volatile credit risks, resulting in a USD 553 million cargo service financing gap in Hong Kong.

In addition to the exchange of physical goods, global trade relies on a cargo services ecosystem, a vital yet often overlooked facilitator of international trade activity.

Products

Our financing products are specifically designed to cater to the needs of the Hong Kong port community, offering a range of digital payment and finance solutions. We leverage trusted data, advanced analytics, and cutting-edge technologies to address challenges associated with traditional payment and financing methods. Conventional financial institutions often burden applicants with extensive information and document requirements, causing difficulties in meeting these criteria. With a strong emphasis on expediting the application review process, we aim to minimize reliance on traditional documentation by utilizing trusted data, resulting in faster access to funds.

Our current offerings are: